Valuations

Valuation is at the heart of our property services since it underpins all property transactions and ownership.

Valuation services for the South West

Our team of RICS Chartered Surveyors and registered valuers provide commercial, residential and specialist sector valuations to high street and private banks, developers, investors, property companies, charities, pension funds and private clients.

Our experts work across the South West undertaking hundreds of valuations each year. Our services incorporate the mainstream commercial and residential sectors and specialisms including leisure, healthcare, development, education and investment. Our comprehensive valuations are provided for single properties and portfolios for a wide range of purposes including secured lending, taxation, acquisition and disposal, accountancy, and expert witness. We aim to add value, not simply report it.

Why choose us?

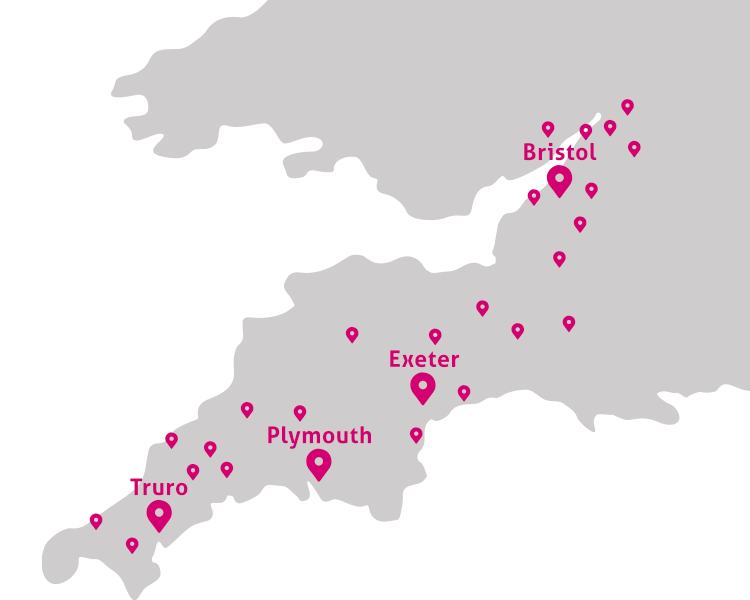

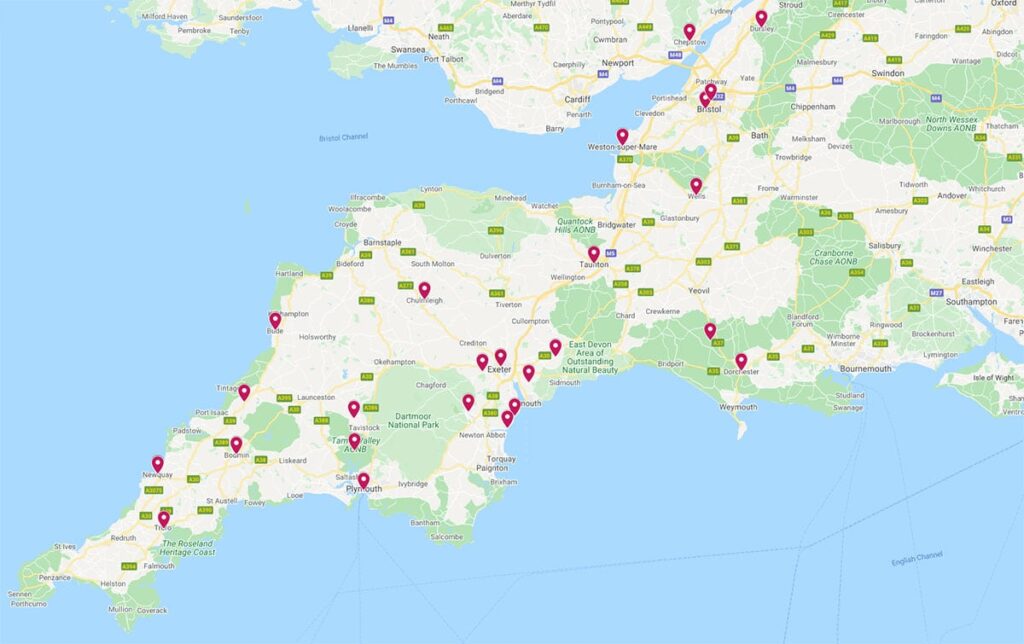

Our team is based across the South West with offices in Truro, Plymouth, Exeter and Bristol; this gives us excellent local and regional market knowledge, used to inform our valuations. All our valuers are RICS Chartered Surveyors guaranteeing you will receive a professional and impartial valuation.

Our Valuation services

Charities Act

We work with charities and trustees to value property under Section 117-121 of the Charities Act 2022. Our valuations are provided for disposal and acquisition of properties, or for the granting of long leases. With our knowledge of the Charities Regulations 1992 and the appropriate sections of the Act, we provide advice to a wide range of charities across the South West, covering a variety of property types.

Commercial Valuation

We provide valuation advice on the main commercial sectors including offices, retail and industrial. Our valuations are provided for a variety of purposes including secured lending, taxation or as an expert witness. We work closely with our agency teams to ensure our valuations are market facing.

Compulsory Purchase & Compensation

A complex area of valuation, we provide advice to those affected by Compulsory Purchase Orders (CPOs). We provide advice on the diminution in value of property and negotiate sales by agreement or claims of a CPO. We respond to statutory notices, submit objections and act as an expert witness. It is often the case the cost of professional advice incurred in connection with CPOs is recoverable from the acquiring authority. Please do not hesitate to contact us for advice.

Expert Witness & Dispute Resolution

We understand dispute resolution and the need to appoint an expert witness can be difficult. Our experienced team provide independent advice to a variety of clients in relation to property disputes including matrimonial matters, dilapidations (Section 18), disputes involving covenants and rights of way and more. We can act as an expert witness, mediator and arbitrator when required.

Lease Extensions & Enfranchisement

A specialist area of valuation, we provide advice to freeholders and leaseholders for residential freehold purchases and lease extensions. We provide advice on the premium payable under the relevant Leasehold Reform Act, negotiate in the best interest of our client and act as an independent expert at valuation tribunal. We provide advice for:

- 1993 Act Claims for Lease Extensions of Flats

- 1993 Act Claims for Collective Enfranchisements of Block of Flats

- 1967 Act Claims for Enfranchisements of Houses

Leisure Valuation

We provide valuation advice for all types of leisure and trade related properties including hotels, touring and caravan parks, guest houses, holiday complexes and licensed premises. Working on behalf of a variety of clients for purposes including secured lending, acquisition and taxation, we can value as a trading business and provide advice on alternative uses.

Pension Valuation

We undertake pension valuations for several SIPP and SSAS providers (pension providers) including Curtis Banks and Standard Life.

Residential Valuation

We value a range of residential properties including townhouses, cottages, farmhouses, period and listed buildings, contemporary coastal dwellings, and country manor houses. We value both freehold and leasehold interests which are owner occupied, used for holiday letting or other investment purposes, including Houses in Multiple Occupation (HMO).

Secured Lending Valuation

Valuations are a fundamental part of securing finance on a property. We are on over 30 bank panels of all the major high street lenders as well as the challenger banks and peer to peer lenders. We undertake secured lending valuations efficiently to provide our clients with a thorough and prompt service utilising our local knowledge.

Tax, Trusts & Accounts

Our valuations are used for a variety of purposes including inheritance tax, capital gains tax and stamp duty land tax.

Capital Gains Tax

Following the disposal of any property, which is not the principle private residence and where the asset has increased in value, Capital Gains Tax is payable. Capital Gains Tax is usually based on the difference between what you paid for an asset and how much you sold it for. You will need to submit a market valuation to HMRC or the District Valuer if any of the following applies:

- The property was gifted

- The property sold for less that its value

- Inherited assets

- Assets purchased before April 1982

Vickery Holman has roots back to 1848 and with several of our staff working for the company since the 1980’s. We have internal records of transactions from the 1982 date required for Capital Gains valuations.

Inheritance Tax / Probate

A ‘Red Book’ valuation carried out by a RICS Registered Valuer is recommended where it is believed tax will be due to HMRC from a person, or estate, subject to inheritance tax. The valuation will be carried out reporting the valuation in the open market at the date of death.

Stamp Duty Land Tax

When ownership of a share of a property or an entire property is to be sold or transferred, a value must be given to assess the amount of SDLT payable to HMRC.

We liaise with the District Valuer in connection with all the above and are prepared and able to handle any enquiries on your behalf.

Key Contacts

Valuations Case Studies

Valuation FAQs

What is an RICS Registered Valuer and What is the Red Book?

RICS is the Royal Institution of Chartered Surveyors, a global professional body dedicated to promoting and enforcing the highest international valuation, land development and management, real estate, construction and infrastructure standards. Using an RICS Registered Valuer means that you get an impartial, professional valuation based on in depth local knowledge.

An RICS Valuation is a professional assessment by a RICS registered valuer of the Market Value of property or land, taking several factors into account which impact on a valuation, including current market conditions, location, size and condition of property and any adverse factors that may impact the value. Valuations may be carried out for a number of reasons, the most common being for a mortgage or lending purpose, insurance or as part of an investment/asset valuation.

The Red Book is simply the publication that covers the valuation standards set by RICS that all registered valuers have to adhere to. The Red Book sets out the professional standards and guidelines that valuers have to meet.

Why do I need a valuation on my commercial property?

You may need a valuation on your commercial property because you need an impartial opinion for mortgage or lending purposes, or because you plan to sell or let your property. There are many reasons why you would want to have a valuation but you should use a registered RICS Valuer to ensure you receive the highest professional level of service.

The most common reasons for a commercial property valuation include:

- Assessing the value to put the property on the market

- Reassuring a buyer or tenant that the price/rent you are charging is reasonable and inline with market values

- For a mortgage underwriter, so they know your property is worth the money they are lending

- For compulsory purchase

- Valuing assets as part of liquidation, merger or acquisition

How do you value a commercial property?

A commercial property can be valued by for example, calculating the value based on the passing rent and Market Rent for the property. Market Rent is assessed by comparison of open market rental transactions of similar properties within the locality. If a commercial property is vacant, similarly we would compare vacant possession transactions in order to establish a value.

For a residual development valuation, a valuer would calculate the value of the finished development then minus costs, for example of construction and professional fees, to give a value for the property or land. Valuers also look at the market values of similar properties in the locality and consider the factors that would increase or decrease the value of your property.

A professional valuation of a commercial property can be complicated and will look at a multitude of factors from the location to the rental income to the quality of the building materials.

What is a ‘Red Book’ valuation?

A Red Book valuation is a term used to signify that a valuation has been carried out by a fully trained and registered professional RICS Registered Valuer. The Red Book is simply the publication that covers the valuation standards set by RICS that all registered valuers have to adhere to. The Red Book sets out the professional standards and guidelines that valuers have to meet.

What are the most important factors in a valuation?

The most important factors in a valuation are;

- Who carried out the valuation? Using an RICS Registered Valuer will give you a professional, impartial opinion

- Market Values in the region

- Location

- Current purpose of the land/property and potential development options

- Condition of the land/property

There are many factors that impact on a valuation, so please contact us to talk to an RICS Registered Valuer in your area. We have 22 Valuers across the South West.

What is a lending panel?

A lending panel is a list of approved firms who can act on behalf of a particular mortgage provider or lender. Those providers or lenders will only accept valuations from approved valuation companies, like Vickery Holman.

We are on the panel for most of the main high street lenders, as well as more specialist lenders for residential or commercial properties.

Which geographical area does Vickery Holman cover?

Vickery Holman covers the South West of the UK with 22 Valuers based from Truro to Bristol. We have 4 offices, in Truro, Plymouth, Exeter and Bristol but our Valuers have in-depth local knowledge in addition to our regional and national expertise. Please see the map below to see where our Valuers are based.

How can I get a valuation on my commercial property?

RICS Registered Valuers are the recommended route for an impartial, informed valuation on your commercial property. Contact our valuation team for advice on what valuations we can provide. Vickery Holman has one of the largest team of RICS Registered Valuers in the South West with over 20 valuers. Our team benefit from in-depth local knowledge as well as our shared regional knowledge.