Financial Viability Assessments

Financial Viability Assessments (FVAs) are central in the development process being the tool that judges the financial ability of a proposed development to fulfil Local Plan policies including provision of affordable housing and other community services.

Home / Services / Development Consultancy / Financial Viability Assessments

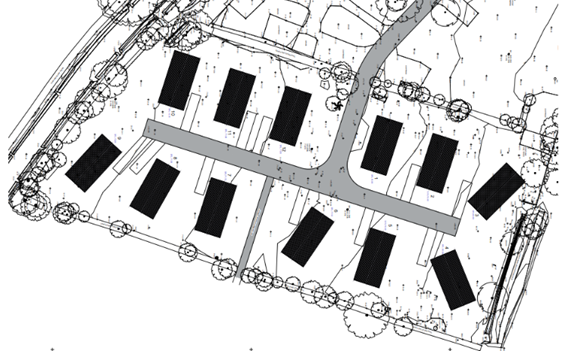

Financial Viability Assessments services for the South West

The assessment is carried out in the form of an independent appraisal and recommendations report to the Local Planning Authority (LPA) and is used to inform negotiations with the LPA. The appraisal takes into consideration the specifics of each site and Plan policy requirements to determine a balance between development profit and community infrastructure that facilitates development.

Vickery Holman have a long history and strong track record of finding the balance and creating viable deliverable developments. We have experience of dealing with sites ranging from small rural exception schemes to larger volume housing sites and have agreed dozens of s106 terms with different LPA’s across the region. The support provided by our Agency and Building Surveyors on values and costs, and our practical development experience provide all the necessary knowledge to deliver a high quality and reliable service. For more information on s106, please click here.

Our experience and integrity are widely acknowledged and consequently we frequently provide independent expert third party reviews on FVA’s prepared by others.

Seeking professional advice from a local expert early on in the process is important not only in ensuring a scheme is viable but will help avoid delays and untenable planning agreements that threaten the deliverability and success of projects.

Please get in touch for a free consultation.

Financial Viability Case Studies

Financial Viability Assessments FAQs

Question?

Answer…

Question?

Answer…